Hey there, recent graduates! Congratulations on tossing that cap and taking that first big step into the “real world.” It is an exciting time, filled with new beginnings and (hopefully) a decent paycheck. But between celebrating and working, there’s one crucial thing you might be neglecting: INVESTING.

Now, I know what you’re thinking: “Investing? Isn’t that for fancy suits on Wall Street?” Not quite. The truth is that investing early is one of the smartest financial moves you can make. Here’s why:

The Magic of Compounding: Your Money Grows on Money 💰

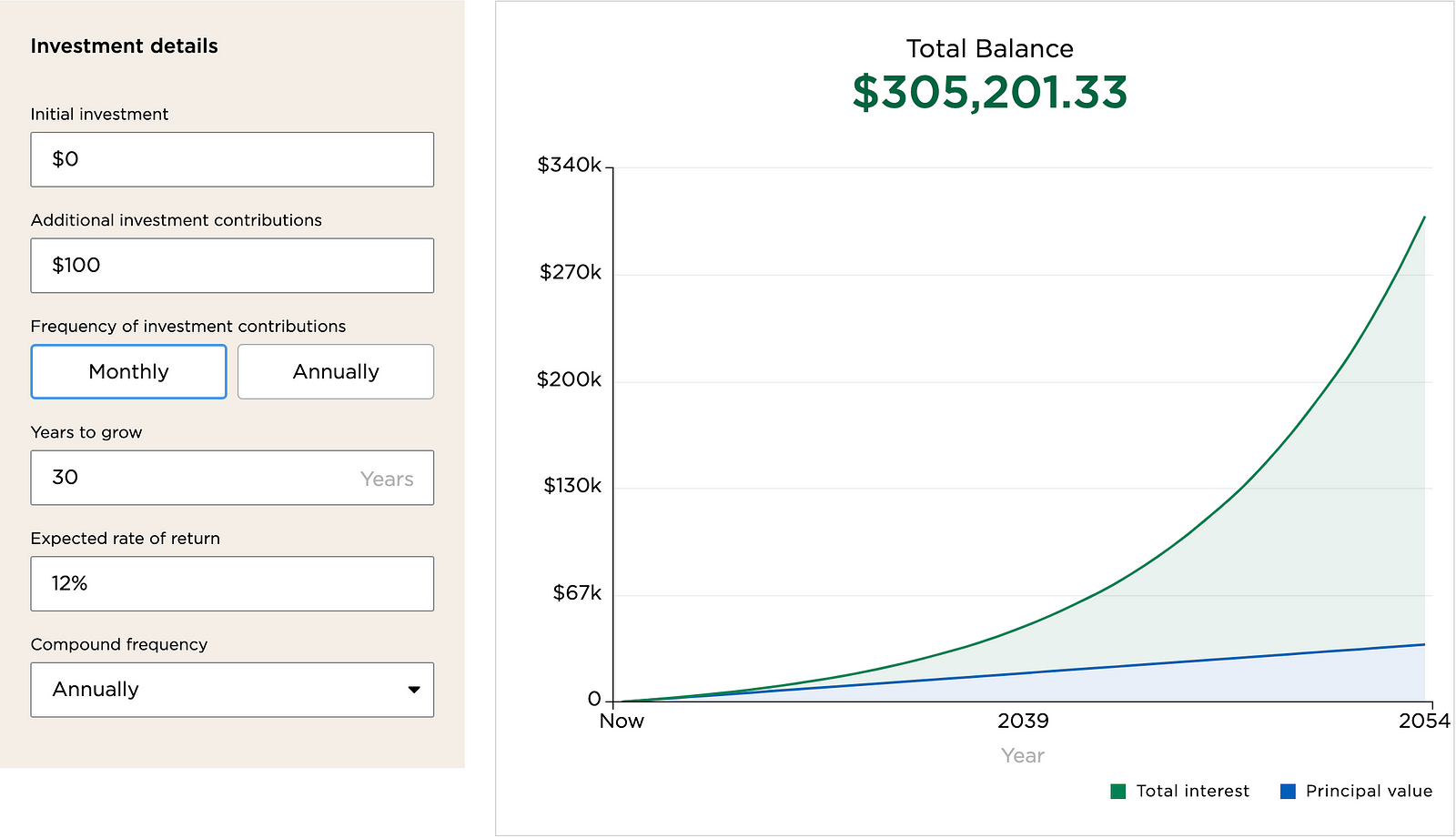

Imagine this: you invest $100 (can be a similar amount in your currency) every month into an investment account that earns a steady 12% annual return (this is a historical average for the stock market around major indices worldwide, but keep in mind there are risks involved). It might not sound like much to you, right? Well, here’s the kicker: thanks to compounding, your money starts growing on itself. That 12% return gets applied not just to your initial $100, but to all the accumulated earnings too. Fast forward 30 years, and that $100 a month could become a whopping $305,000! Crazy, right?

If you can closely observe the chart above, you will notice the blue line is the amount you invested and the green one is the power of compounding.

Me? I Wish I Started Sooner 🤦

Now, let me tell you a story. Back in the day, I used to think investing was complicated and best left to the professionals. That was such a huge mistake. By the time I woke up and started investing, I had missed out on years of compounding magic. Don’t be me!

Start Small, But Start Now 📈

The beauty of investing young is that you don’t need a fortune to get started. Even a small amount invested early can reap huge rewards down the line. Think of it as planting a seed — the sooner you plant it, the bigger the tree it’ll grow into someday.

Ready to Take the Plunge? Here are some advice: 💡

- Index mutual funds: For beginners, Investing in an index mutual fund could be your safest bet as they offer the least amount of risk and have a lower expense ratio.

- Equity Investing: You can start investing by buying stocks of some large-cap companies e.g.- Amazon or Microsoft in the US. Reliance or HDFC Bank in India. Please note that these are just examples and not investment advice. You should invest as per your risk appetite.

- Financial literacy resources: There’s a lot of information available online be it YouTube or some professional courses you can take to become an investment tycoon.

Remember, investing is a marathon, not a sprint. There will be ups and downs along the way, but by staying disciplined and focused on the long term, you’ll be well on your way to financial freedom. So, what are you waiting for? Start investing today and watch your money grow!